(Editor’s Note: Time to get serious about organizing, folks, so we can grab back our stolen wealth from the rich! Remember: It is our childrens’ futures we are taking about. Grab it or lose it. Stand or crawl. – Mark L. Taylor)

By Juan Cole

Informed Consent (12/20/17)

The Republican Party did not just overhaul the tax code and they did not cut “your” taxes. They engineered a coup against the middle and working classes and they threw enormous amounts of public money to private billionaires and multi-millionaires.

Americans do not understand this sort of con game because mostly they don’t understand social class. They often don’t even believe in the latter. But really, not all households in the US are equal. Some have more income than others. Some have more power than others. And as with the Trumps, that wealth and power can be passed on to the next generation.

We’re not all middle class. That would make a mockery of the word “middle,” which implies that there are lower and upper classes. Some of us are working class, some are middle class, some are upper middle class, and some are rich. Policies that help the rich by cutting their taxes do not help the working and middle classes. They actively harm the latter by making less money available for government services and by devaluing the dollar.

The Republican Party mainly represents the rich. It also reaches out to rural people and claims to help them, but it is all lies. It mainly represents the rich.

Americans’ wealth amounts to about $88 trillion. If you divided up all the privately held wealth equally, every household in the US would be worth $698,000. That is, they’d all have their own home plus substantial investments.

Alabama routinely votes Republican. Alabama is one of the poorest states in the country. The Republicans aren’t actually doing anything for Alabama, except maybe making them feel good about themselves by buttering them up, or indulging them in their weird idea that fundamentalist Christianity should dictate social policy to 320 million Americans, who do not share those values.

The rich in the United States use American highways, and American wifi, and depend on the FBI to keep them from getting kidnapped. But they don’t want to pay for those things. They want you to pay for them even though they use them much more. I get angry when I see those trucks on the highway with the sign that they paid $9277 in tolls and fees last year to be on the highway. Trucks are the ones that tear up the highways and force us to spend hundreds of millions of dollars to rebuild. Their fees and tolls don’t come close to paying for the damage they do. So the costs are offloaded.

Onto us?

Onto us.

There are about 126 million households in the United States. One percent of them would be 1.26 million households. That is about the size of the city of Los Angeles. There are one hundred groups of 1.26 million households in the US, i.e. 100 Los Angeleses worth of households. Those one hundred groups are not equal in wealth. The bottom 100th of American households doesn’t have a pot to pee in.

The Republican Party slavishly serves the top 1.26 million households. That’s who they report to. That’s who sent them to Congress, through their campaign donations. They don’t care about you and they did not just now do you any favors.

The wealthiest one percent owns about 38 percent of the privately held wealth in the United States. In the 1950s, the top 1% only owned about 25 percent of the privately held wealth. A Republican was in the White House, Dwight Eisenhower. He was not a left wing guy. But he worried about corporations combining with government officials to become way more powerful. The last time wealth inequality was this high was just before the Great Depression. Think about that.

Here’s the truth about American class & wealth

Americans’ wealth amounts to about $88 trillion. If you divided up all the privately held wealth equally, every household in the US would be worth $698,000. That is, they’d all have their own home plus substantial investments.

But needless to say, the wealth isn’t divided up equally. The top ten percent of households, 12.6 million households own 76% of the privately held wealth. That is, 10 of our notional 100 Los Angeleses own three-fourths of the wealth. …

Read the Rest and Graphs That Will Tell You The Truth About American Class System

*****

Wisconsin Sen. Ron Johnson One Of The 14 Senate Hyena’s Cashing In On GOP Tax Heist’s #CorkerKickback

By Jake Johnson

Commone Dreams (12/19/17)

The GOP tax bill expected to hit the floor of Congress for a vote Tuesday afternoon has been characterized as legislation “written for Republicans’ wealthy campaign contributors,” but a report published Monday made clear that Republicans are not just attempting to fatten the already-overflowing pockets of their donors—they’re also doing all they can to “feather their own nests.”

According to an analysis of federal records by the International Business Times (IBT), a “special provision” buried in the 500-page Republican tax bill—which has come to be known as the #CorkerKickback—could amount to a combined $14 million annual income boost for “more than a quarter of all GOP senators.”

As IBT reports:

“In all, 14 Republican senators (see list below) hold financial interests in 26 income-generating real-estate partnerships—worth as much as $105 million in total. Those holdings together produced between $2.4 million and $14.1 million in rent and interest income in 2016, according to federal records.

“IBT first reported on the tax carve-out, which allows investors in “pass-through” entities, including real-estate partnerships such as LLCs and LPs, with few employees to deduct part of their income that passes through those partnerships.”

Along with Sen. Bob Corker (R-Tenn.), one of the wealthiest members of Congress, the other senators who stand to benefit include Orrin Hatch (R-Utah)—who admitted on Monday that he authored the provision—and Ron Johnson, who has an estimated net worth of $36 million. Some of the senators on the list also happen to be recipients of large sums of campaign cash from the real estate industry, IBT adds.

Kickbacks

Trump—who has claimed repeatedly and falsely that the tax bill will cost him and his rich friends “a fortune”—could also see a nice profit from the last-minute addition to a bill already stuffed with corporate giveaways. As IBT notes, Trump “owns or directs over 560 companies” that will get a tax cut thanks to the real estate pass-through provision.

The discovery of the #CorkerKickback quickly sparked fury on social media, which translated into intense pressure on Corker and other Republican senators to explain how a measure that would personally enrich them ended up in the final version of their deeply unpopular bill.

In a letter on Monday, Hatch expressed “disgust” at press reports suggesting that the provision may have been included for reasons of self-interest or in an effort to win Corker’s vote. But, as IBT reports, Hatch didn’t deny that he stands to benefit from the measure he is helping ram through Congress, nor did he “dispute that Corker voted against the Senate bill when it restricted him from getting a personal benefit, and then switched his position and announced his support for the final bill after it included” the “Corker Kickback.”

As the lead editorial in Tuesday’s New York Times notes, “The tax bill’s generosity toward real estate titans stands in stark contrast to its stinginess toward the average wage earner as well as its very real damage to taxpayers in high-cost states.”

“Whatever the Republicans’ protestations,” the Times concluded, “this malodorous loophole is further confirmation that congressional leaders are doing everything they can to maximize benefits for the wealthy at the expense of almost everybody else.”

(This work is licensed under a Creative Commons Attribution-Share Alike 3.0 License.)

*****

Trump Will Personally Save Up To $15m Under Tax Bill, Analysis Finds

Jared Kushner will save up to $12m, while five other members of Trump’s inner circle will also see benefits worth millions of dollars

By David Smith

The Guardian (12/20/17)

Donald Trump and six members of his inner circle will be big winners of the Republicans’ vast tax overhaul, with the president personally benefiting from a tax cut of up to $15m a year, research shows. … Read the Rest

*****

House Republicans Don’t Know Some Very Basic Facts About The Tax Bill They Wrote

It took us 18 tries to find a GOP congressman who could tell us the individual income tax brackets.

By Matt Fuller

The HuffPost (12/20/17)

WASHINGTON ― House Republicans swear they had enough time to review a 500-page conference report released last Friday night before they voted on what they thought would be the final tax bill Tuesday. (They actually had to vote on the bill again Wednesday because of a parliamentary mishap.) But when we asked GOP lawmakers supporting the legislation this week for just one basic detail of the bill ― the tax bracket percentages for individual income ― hardly anyone could list them.

HuffPost had to ask 18 House Republicans to identify the tax brackets before we finally came across one member who could: Rep. Chris Stewart of Utah. (We stopped asking after Stewart, meaning the percentage of the House GOP conference who knew this key aspect of the bill could have been much worse than our imperfect survey suggests.)

Asking those members of Congress to name the seven tax brackets was, of course, a gotcha question. It was also an entirely fair question ― listen to our interviews below and you can hear that the lawmakers knew they were supposed to know.

To be clear, we were just looking for seven figures: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. We were not looking for congressional representatives to display some savant-like ability and provide the income thresholds for each bracket. We just wanted to see if Republicans knew this one simple element of a bill they were rushing into law.

They didn’t.

Among the GOP lawmakers who were shaky on those specifics were members of the tax-writing House Ways and Means Committee, the chairwoman of the House Budget Committee (Rep. Diane Black of Tennessee) and the lead author of the bill in the House (Ways and Means Chairman Kevin Brady of Texas).

“So the seven brackets?” Brady said when we asked him. “So you got them right there. I’m heading to the floor and finishing my remarks on this tax cut and reform jobs act, so thank you.”

When we pressed Brady again to name the brackets, he dismissed the question. “So please, please. Seriously? I would like to finish my job,” he said.

Even though Brady almost certainly should know the brackets in a tax bill he is authoring, the Ways and Means chairman was in good company. …

Read the Rest and 4-Minute Audio

(Commoner Call cartoons by Mark L. Taylor, 2017. Open source and free to use with link to www.thecommonercall.org )

*****

Here Are The 227 GOP House Members Who Just Voted To Raise Taxes On 90 Million Working Families To Give Tax Breaks to Millionaires and Corporations

By Common Dreams Staff (12/19/17)

After Republicans in the House of Representatives voted Tuesday to approve a tax plan that will give massive tax cuts to corporations and millionaires at the expense of 90 million working families, opponents who have spent months advocating against the proposal condemned the lawmakers who passed it.

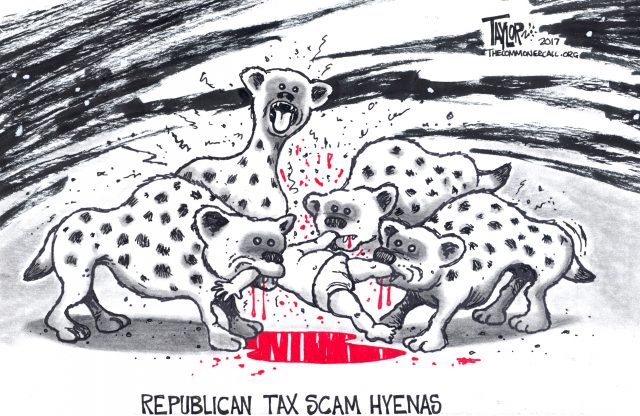

“These are the 227 GOP House members who voted for the #GOPTaxScam. They voted to raise taxes on over 90M working families, while giving massive tax breaks to millionaires and corporations that will be paid for by cuts to Social Security, Medicare, Medicaid, and education. SHAME!” Americans for Tax Fairness tweeted after the vote, accompanied by what they called a “list of shame.” … Link to Story And List Of Republican Hyenas

-

George Carlin Lays Out Just How Bad It Can Get … And Our Salvation: Link to 6+-Minute Video