“There’s been class warfare going on for the last 20 years and my class has won.”

— Warren Buffet, billionaire investor

By Jonothan Aldred

The Guardian (6/6/19)

In most rich countries, inequality is rising, and has been rising for some time. Many people believe this is a problem, but, equally, many think there’s not much we can do about it. After all, the argument goes, globalisation and new technology have created an economy in which those with highly valued skills or talents can earn huge rewards. Inequality inevitably rises. Attempting to reduce inequality via redistributive taxation is likely to fail because the global elite can easily hide their money in tax havens. Insofar as increased taxation does hit the rich, it will deter wealth creation, so we all end up poorer.

One strange thing about these arguments, whatever their merits, is how they stand in stark contrast to the economic orthodoxy that existed from roughly 1945 until 1980, which held that rising inequality was not inevitable, and that various government policies could reduce it. What’s more, these policies appear to have been successful. Inequality fell in most countries from the 1940s to the 1970s. The inequality we see today is largely due to changes since 1980.

Inequality begets further inequality. As the top 1% grow richer, they have more incentive and more ability to enrich themselves further. They exert more and more influence on politics, from election-campaign funding to lobbying over particular rules and regulations. The result is a stream of policies that help them but are inefficient and wasteful.

In both the US and the UK, from 1980 to 2016, the share of total income going to the top 1% has more than doubled. After allowing for inflation, the earnings of the bottom 90% in the US and UK have barely risen at all over the past 25 years. More generally, 50 years ago, a US CEO earned on average about 20 times as much as the typical worker. Today, the CEO earns 354 times as much.

Any argument that rising inequality is largely inevitable in our globalised economy faces a crucial objection. Since 1980 some countries have experienced a big increase in inequality (the US and the UK); some have seen a much smaller increase (Canada, Japan, Italy), while inequality has been stable or falling in others (France, Belgium and Hungary). So rising inequality cannot be inevitable. And the extent of inequality within a country cannot be solely determined by long-run global economic forces, because, although most richer countries have been subject to broadly similar forces, the experiences of inequality have differed.

The familiar political explanation for this rising inequality is the huge shift in mainstream economic and political thinking, in favour of free markets, triggered by the elections of Ronald Reagan and Margaret Thatcher. Its fit with the facts is undeniable. …

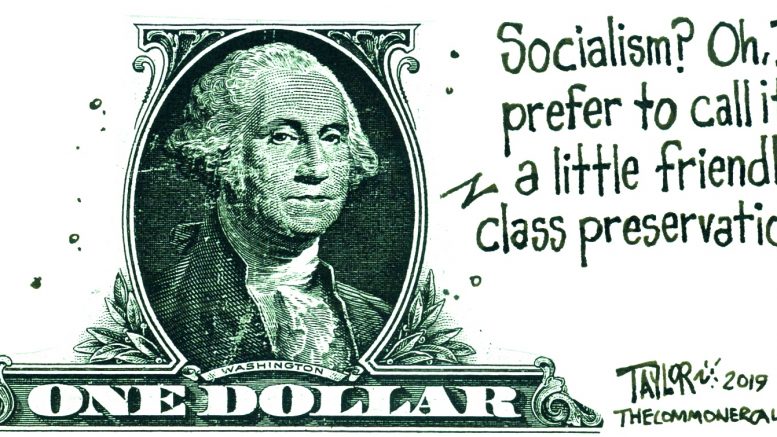

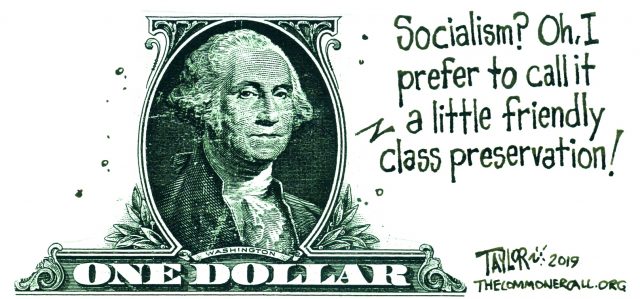

(Commoner Call cartoon by Mark L. Taylor, 2019. Open source and free for non-derivative use with link to www.thecommercall.org )

*****

Even The 1% Agree They Aren’t Paying Their Fair Share: New Poll Shows 60% Of Millionaires Support Warren’s Ultra-Wealth Tax

By Jon Queally

Common Dreams (6/12/19)

“Taxing the rich is popular among… the rich!”

That was the comment from the Patriotic Millionaires, a group representing progressive people of wealth who call for higher taxes on themselves, in reaction to a new CNBC poll out Wednesday that showed a full 60 percent of millionaires surveyed voiced support for the wealth tax proposal put forward by 2020 Democratic presidential candidate Sen. Elizabeth Warren.

“A majority of Americans, even the 1% of us, know that our inequality is out of control and we need to make some big changes if we want to fix things,” the group said on Twitter.

According to CNBC:

“Fully 60% of millionaires support Warren’s plan for taxing the wealth of those who have more than $50 million in assets, according to the CNBC Millionaire survey. The wealth tax is different from an income tax, since it taxes a family’s total holdings every year rather than their income.

“”Polls show that a majority of Americans also back a wealth tax. But the support from millionaires, some of whom would presumably pay the tax, shows that some millionaires are willing to accept higher taxes amidst growing concern over inequality and soaring fortunes of the rich.

While 88% of Democrats support the wealth tax, 62% of independents support it along with 36% of Republicans. Even the upper tier of millionaires, those worth more than $5 million, support a wealth tax, with two-thirds in favor.”

“Even the wealthy know they haven’t been paying their fair share,” tweeted Tax March, a progressive taxation and economic justice group which is spearheading an upcoming nationwide “Tax the Rich” tour.

As Common Dreams reported when she released the plan in January of this year, Warren’s proposal calls for a 2 percent tax on individual and family wealth over $50 million and 3 percent tax on wealth that exceeds $1 billion.

Wealth is not income

As economist and former U.S. labor secretary Robert Reich detailed earlier this year in a video and companion column, “Wealth isn’t like income. Income is payment for work. Wealth keeps growing automatically and exponentially because it’s parked in investments that generate even more wealth.”

Citing that estimate that a wealth tax like Warren’s could as much as $2.75 trillion dollars over the next decade—revenue that could be utilized for health care, education, infrastructure, and much else—Reich argues that “Not only would a wealth tax raise revenue and help bring the economy back into balance, but it would also protect our democracy by reducing the influence of the super-rich on our political system.”

(Our work is licensed under a Creative Commons Attribution-Share Alike 3.0 License. Feel free to republish and share widely.)

Link to Story and 4-Minute Video