By Jon Queally

Common Deams (2/15/18)

“Remember these names the next time Wall Street tanks our economy and taxpayers are left to bail out the Big Banks.”

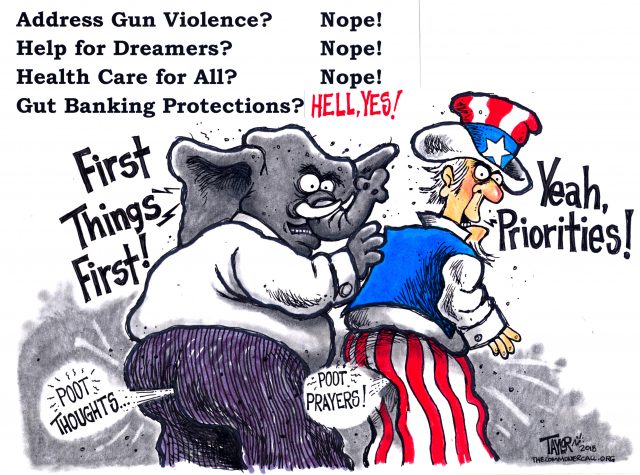

That was the declaration by the progressive advocacy group Public Citizen late Wednesday after 17 members of the Democratic caucus in the U.S. Senate joined with Republicans to pass a sweeping deregulatory banking bill, derisively referred to as the “Bank Lobbyist Act” by critics.

In addition to Sen. Angus King (I-Maine), 16 Democrats joined a unified Republican caucus in approving the so-called “Economic Growth, Regulatory Relief, and Consumer Protection Act”: Michael Bennet (Col.), Tom Carper (Del.), Chris Coons (Del.), Joe Donnelly (Ind.), Maggie Hassan (N.H.), Heidi Heitkamp (D-N.D.), Doug Jones (Ala.), Tim Kaine (Va.), Joe Manchin (W.Va.), Claire McCaskill (Mont.), Bill Nelson (Fla.), Gary Peters (Mich.), Jeanne Shaheen (N.H.), Debbie Stabenow (Mich.), Jon Tester (Mont.), Mark Warner (Va.).

The explanation for the lawmakers’ support for the bill, said Public Citizen, isn’t hard to explain or understand:

NOTE: The image of the payoff graphic would load, follow link below.

“Washington insiders are telling a story about centrist Democrats up for reelection aiming to demonstrate their commitment to bipartisanship,” said the Robert Weissman, the group’s president, in a statement. “But that fairy tale is upside down: among the public, there is in fact overwhelming bipartisan opposition to Wall Street deregulation.”

And Public Citizen was hardly alone in expressing its frustration with the 16 Democrats and Sen. Angus King, Independent of Maine, who caucuses with them:

(This work is licensed under a Creative Commons Attribution-Share Alike 3.0 License.)

Read the Rest and 8-Minute Video

*****

Blasting #BankLobbyistAct, Warren Unveils “The Ending Too Big to Jail Act” To Fight Wall Street Greed

By Andrea Germanos

Common Dreams (3/14/18)

With the Senate voting on a Wall Street deregulation bill as early as Wednesday evening, U.S. Senator Elizabeth Warren (D-Mass.) marked today’s 10-year anniversary of the financial crisis by unveiling new legislation that—in contrast to the “Bank Lobbyist Act“—aims to curb the fraud and greed of large financial institutions.

“When Wall Street CEOs break the law, they should go to jail like anyone else. The fraud on Wall Street won’t stop until executives know they will be hauled out in handcuffs for cheating their customers and clients,” Warren declared in a statement.

“The fraud on Wall Street won’t stop until executives know they will be hauled out in handcuffs for cheating their customers and clients.”

Entitled “The Ending Too Big to Jail Act,” the legislation (pdf) calls for three major changes to address the problem of financial executives not being held criminally responsible for the 2008 crisis. A fact-sheet laying out the proposals explains how they would:

- Make the Special Inspector General for the Troubled Asset Relief Program (SIGTARP) the Special Inspector General for Financial Institution Crime (SIGFIC), recognizing SIGTARP’s “specialized skills and expertise”;

- Require accountability from executives at institutions of $10 billion more in assets by having them certify annually that they have conducted due diligence and found no criminal conduct or civil fraud within their institution;

- Require judicial oversight of deferred prosecution agreements (DPAs) between financial institutions and the Justice Department.

Instead of passing the Bank Lobbyist Act, formally known as S. 2155, Warren said that “Congress should be marking the tenth anniversary of the financial crisis by strengthening rules on banks and bankers so Wall Street can never again get away with cheating Americans and crashing the economy.”

Warren has been a vocal opponent of the deregulation bill—which the Congressional Budget Office (CBO) found would be a massive gift to some of the same Wall Street banks that led to the 2008 crash—and has also spoken out against her Democratic colleagues that are backing it.

Speaking on the Senate floor on Wednesday, Warren said that S. 2155 not only increases the chance for another financial meltdown, it has “landmines for American families.” If it passes, she argued, the bill “guts protections for families that buy traditional and mobile homes and undermines our ability to enforce civil rights laws. And for what? So that banks that are already making record profits can tack on a little more to their bottom line?”

“If the Senate is going to spend two weeks dealing with the big banks, we should be making the rules tougher, not weaker. Today, I introduced the Ending Too Big to Jail Act, which would help make sure big bank executives are hauled out of their corner offices in handcuffs the next time they break the law,” she continued. “That would do more for America’s working families than anything in this bill—and I’m going to fight to make it the law.”